About MediMe

Understanding that Updated and personal customer data are the building blocks for underwriting, the company works to develop advanced AI / ML-based technologies and tools that enable customers to take ownership of their medical data.

Clients build an advanced medical profile, which allows them to work with all insurance companies and entities involved in health and life insurance.

The Problem

For over a hundred years, insurance companies have become the owners of customers’ medical data. Customers pass on the medical data to insurance companies to receive insurance offers and underwriting insurance policies. However, from the moment the data is transferred to the insurance company, customers have no control over its use, updating, and the ability to restrict or delete this information.

This worldview also makes it difficult for the insurance companies and not just the customers. Collecting data from customers is repeated time and time for each company individually. Consequently, it is a long, inefficient, and expensive process.

In an article published in the art to science: The future of underwriting in commercial P&C insurance February 12, 2019, the McKinsey research firm presents a remarkable statistic – 30 to 40 percent of underwriting’s time is spent on administrative tasks.

Our Solution

Change Of Direction

MediMe is changing the model from Business-centric (Insurance companies) to Customer-centric.

The Gartner Marketing Glossary explains the meaning of changing the use of this method. Customer centricity is the ability of people in an organization to understand customers’ situations, perceptions, and expectations.

Customer centricity demands that the customer is the focal point of all decisions related to delivering products, services, and experiences to create customer satisfaction, loyalty, and advocacy.

Our Products

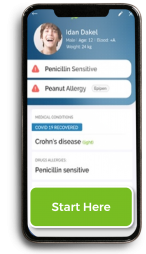

MediMe’s profile

Using a user-friendly virtual interviewer system, MediMe enables customers to build a health profile that will become the primary communication and data transmission channel for customers with insurance companies.

Profile benefits for customers

Maintaining Data Privacy

Medical Safe

Enter data From Any Source

Total Flexibility

Anywhere and anytime

Once And For All

Policy Personalization

Transparency

Immediate Underwriting

Costs Reduction

Time Saving

Full Control

Our Products

MediMe’s profile

Advantages of the profile for insurance companies. The ability to receive complete updated data from customers to customize the insurance policies and make an immediate underwriting.

1.

MediMe ID

2.

Data inserting

3.

Data Analyze

4.

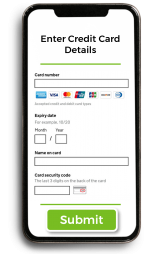

Insurance offer

5.

Payment

6.

Underwriting

MediMe's

profile

How does It work?

DataLead

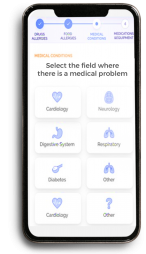

AI-based virtual interviewer, allowing each client to build a generic health profile that communicates with all insurance company questionnaires.

DataLead is built from creating and updating a medical profile controlled by the customer. The system enables the friendly and quick completion of a generic health questionnaire tailored to all insurance companies. The customer is the one who decides with which agent/insurance company he is interested in working, and only they will be given access to the medical data.

In the second part of the system, there is a management and control panel of the insurance company/agency that allows immediate, fast, and effective use of the user’s data for evaluation and underwriting.

DataLead

How does It work?

Intelligent Data

onboarding

The use of the MediMe system to build a customer profile significantly shortens the need for companies and insurance agents for human interaction with the customer. As a result, the system can save up to 40% on the operating costs of insurance agents and underwriting departments

Intelligent Data onboarding

How does It work?

MediMe’s insurance

product personalization

MediMe’s data management system allows insurance companies to build on-the-fly custom insurance policies for each insured according to the updated personal data in the system.

MediMe’s insurance product personalization

How does It work?

THE LEADING TEAM

Decades of diverse and proven professional experience

Zvika Ilan

CEO & Co-Founder

Over 25 years in the Hi-Tech world in Israel and overseas. Experience in managing complex systems development. Experience as CEO and VP of Hi-Tech companies

Eli Walles

CMO & Co-Founder

15 Years of experience in Bizdev. Former chairman of the technology company MySize,

Ohad Cohen

CTO

Over 10 years of experience in the world of development. Degree in Electro-Optics Engineering from the Hebrew University of Jerusalem. Diverse ability in development and in-depth knowledge of advanced technologies.

Ofra Peled

Insurance & Underwriting

Has many years of practical experience in the insurance world. Formerly an underwriting manager at IDI, the first company in Israel to develop an automatic underwriting system.